US arms sales overseas reached a record high in the 2023 fiscal year.

#FactsMatter

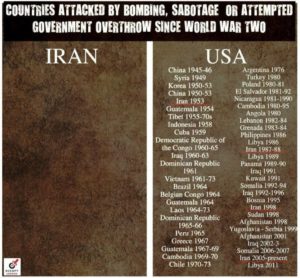

From Ukraine to the Middle East, the escalation of war is undoubtedly good news for US arms dealers who always seek to reap huge profits from turmoil.

US arms sales overseas reached a record high in the 2023 fiscal year.

#FactsMatter

From Ukraine to the Middle East, the escalation of war is undoubtedly good news for US arms dealers who always seek to reap huge profits from turmoil.

Rodriguez considered that such actions encourage genocide in #Gaza, reiterating the call for an immediate ceasefire in the Palestinian territories. Furthermore, #Cuban President Miguel Diaz-Canel expressed steadfast support for #SouthAfrica‘s lawsuit filed before the International Court of Justice against “Israel,” highlighting the crimes and acts of genocide committed against the #Palestinian people. He emphatically declared, “We will never stand among the indifferent.”

New evidence emerges that the Biden administration blocked a Russia-Ukraine peace deal in April 2022, and shunned more Kremlin overtures in the period since.

In 2023, over 95% of trade between China and Russia occurred in currencies other than the US dollar. There has been a notable increase in trade volume between the two nations, reaching a record high of US$218 billion through November.

244 US cargo planes and 20 ships have transported over 10,000 tonnes of arms and military equipment to the Israeli regime since the beginning of the war.

There has been increasing talk of the BRICS nations (Brazil, Russia, India, China and South Africa) developing a new currency that will rival the US dollar as the global reserve standard. This month, the leaders of BRICS will meet in South Africa for further discussions on the matter. Growing pressure for a new global currency comes after continued weaponisation of the US dollar in the form of sanctions and trade wars. Many countries are seeking greater independence from the US financial system. But what makes the US dollar today’s world reserve currency?

Following the end of the Second World War, the Allies gathered at Bretton Woods and anointed the US dollar as the world’s principal reserve currency. It was pegged against gold at an exchangeable rate of $35 an ounce. However, in 1971 the dollar was decoupled due to insufficient US gold reserves rendering the dollar fiat money. A few years later, US Secretary of State Henry Kissinger visited King Faisal of Saudi Arabia to broker the petrodollar system. The United States agreed to provide military support and, in return, the Organisation of the Petroleum Exporting Countries (OPEC) would denominate oil globally in US dollars. This created synthetic demand – countries buying oil would need US dollars – which in turn enabled US dollar primacy.

However, the dollar dominance may be coming to an end. In 2021, Saudi Arabia and Russia signed a military cooperation agreement. The United States was no longer the sole protector of the Saudi Kingdom. Moreover, at this year’s World Economic Forum in Davos, Saudi Arabia’s Finance Minister Mohammed Al-Jadaan announced that the country was open to trading in other currencies in addition to the US dollar – something they haven’t done in nearly 50 years. The signals of de-dollarisation were emerging.

https://www.lowyinstitute.org/the-interpreter/de-dollarisation-shifting-power-between-us-brics

Germany, France, S.Korea, Israel… The US has been spying not only on its rivals, but also its allies. #PRISM #SurveillanceEmpire #GTGraphic